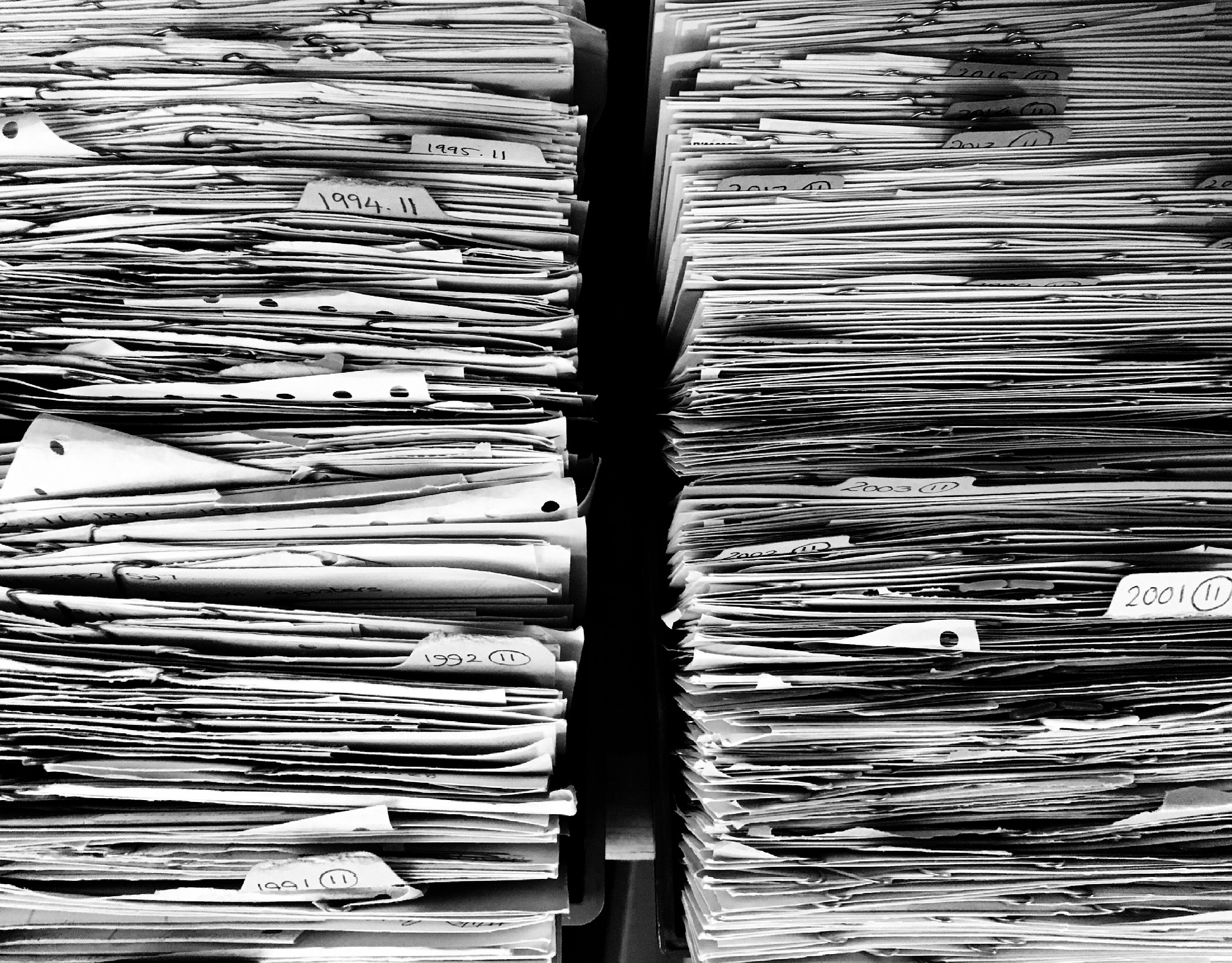

One of the biggest day-to-day issues all businesses face is the collection of unpaid invoices. This is where cash flow finance can really free up your time to focus on your business!

In today’s economic climate it can be very difficult to balance the cash flow of a business if you want to maintain a good relationship with your suppliers. This means paying them on the agreed terms when your clients may be pushing the limits of their payment terms with you.

It doesn’t matter how big or small your business is, there are times when you will need to reduce the risk of late payments – hurting your cash flow and potentially hindering growth.

There are several options when it comes to financing – use a line of credit, take a fixed term loan, refinance a property owned by the business or use invoice financing. This last option is a cost-effective way to deal with unpaid invoices.

Invoice Finance – aka Cash Flow Finance

Madison Wells Pty Ltd through our finance broker team at Astute St Leonards can arrange cash flow finance that pays up to 80% of the outstanding invoice such that your business can remain solvent and pays its dues as and when they fall due.

Facilities have a minimum term of six months. Credit collection and trade insurance services are also available from some finance providers. This means that whilst you run your business, someone else has that difficult talk with your client!

Only invoices issued to Australian businesses can be covered by cash flow finance with approvals typically in as little as 24 hours. Funding can start in 48 hours, so this is a fast way to unlock working capital in the business!

For more information and a non-obligation discussion about cash flow finance, please contact Stephen using this link to book some time with him.