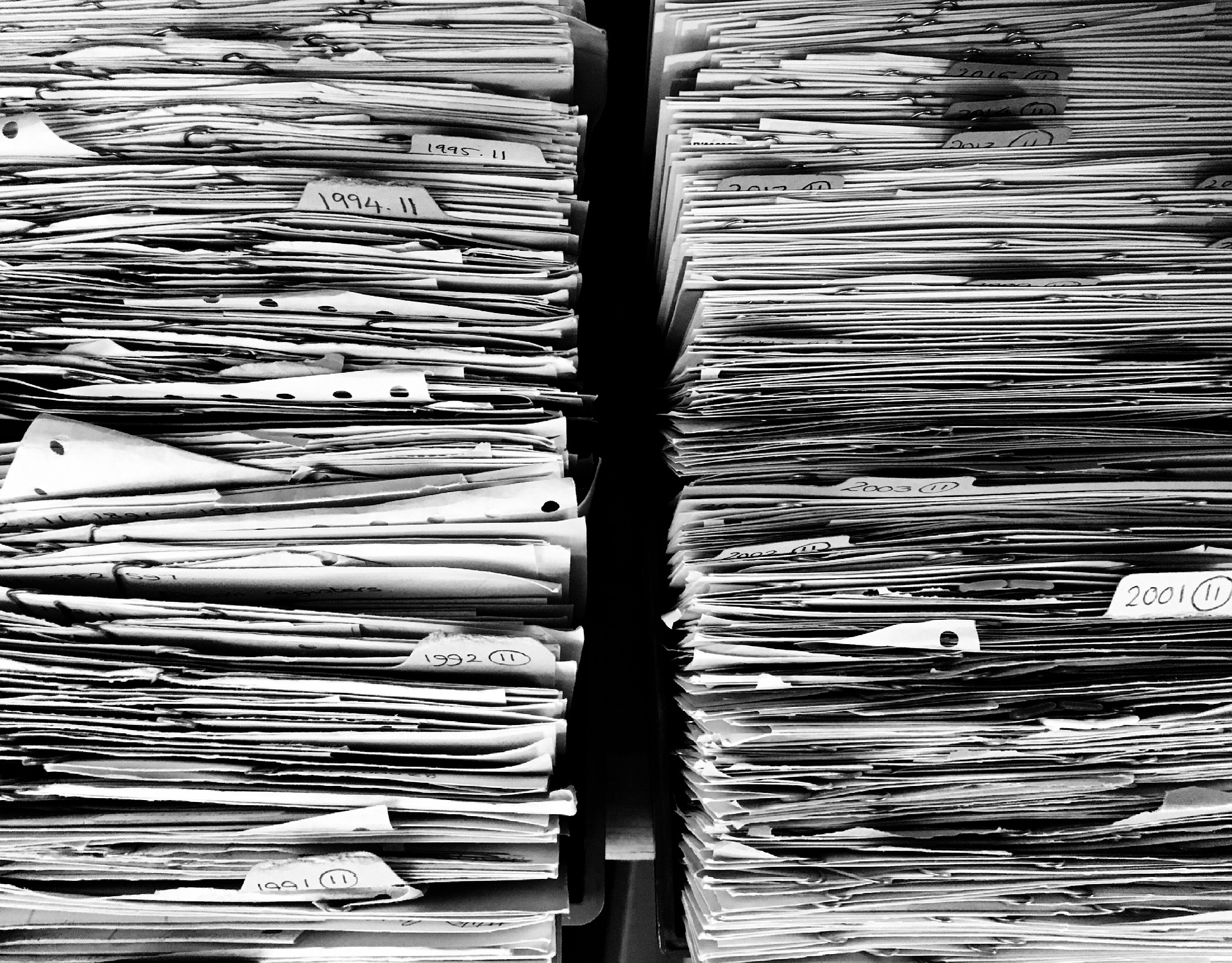

No one likes paperwork, however, providing your broker with the right documentation will save you time and money. It will speed up the time to find you a loan that suits your requirements and this is why brokers ask for so many documents.

What information will your broker ask you to provide?

When you ask a broker like Astute St Leonards, they will probably ask you for the following documentation:

- Identification, including photo ID such as a driver’s licence.

- Income verification documentation such as recent payslips.

- Birth certificate, if you are applying for a government funded first home owner grant.

Depending on the lender or bank you would like your broker to apply to for your loan, you may also be asked to provide:

- A recent Pay As You Go (PAYG) summary.

- A notice of assessment from the Australian Taxation Office.

- Tax returns.

- Proof of your contribution toward the transaction, such as savings or deposit statements.

- Purchase contracts for a home loan, including building contracts, or plans if building a new home.

Why is this information important?

While it may seem that you are climbing the Mount Everest of paperwork, we will ask for all of this to ensure that we are protecting you and that we get the best possible deal for you to accept.

“Gathering various forms of documentation allows brokers to do a fact find, which is an important part of the loan process,” explains Lending Specialist Stephen Wells from Astute St Leonards.

This is the process by which brokers ensure that they match a client with a loan that helps them achieve their property goals, whether that is buying a home to live in, one to renovate and sell, or a long-term investment, and one that matches their financial positions. “Astute St Leonards does not want to put prospective loan clients into a situation where they cannot afford to repay their new loan commitments,” says Wells.

Will a bank ask for the same documentation?

If you apply for a loan with a bank that you do not currently have an account with, they will require much of the same information as the broker would. By having collated it for our compliance processes, Astute St Leonards can then speed up the settlement by having these documents to hand.

Although borrowers may be able to avoid the paperwork by applying for a loan with their current bank (which will already have a lot of information on file), this means being constrained by the products that the bank offers and risking missing out on a great deal.

“The benefit a broker has compared to an individual bank, is the broker – in our case Astute St Leonards – has access to over 30 different banks and lenders across Australia,” Wells said. “Lending policies and pricing vary greatly across the lending market and some clients don’t realise this, so why waste time going direct to a bank?” It is also likely to mean missing out on having a broker match a loan to longer-term goals, rather than just a purchase price and interest rate.

Saving you time and money

Using efficient and connected systems, Astute St Leonards can usually tell a client within 10 minutes whether they have a chance of obtaining loan approval.

Brokers have access to bank loan affordability and serviceability calculators, which show clients’ potential borrowing capacity. Depending on the size of the funding required and the loan to valuation ratio, these days the banks are extremely competitive, and Astute St Leonards can quite often get a better price deal than advertised.

If a client is not yet in a position to obtain a loan or has a credit issue on their file, such as a default, having a broker on-side can be invaluable. Brokers can guide the client with a view of getting defaults removed, or waiting until the default drops off the client’s credit file. Most brokers are accredited to gain access to client’s credit files these days, which is an extremely important issue due to the banks’ risk scoring.

In a nutshell, Astute St Leonards will shop around to get the best possible package for you, the client. This is why brokers ask for so many documents.